In its first opportunity to apply the Framework, the SEC considered two shareholder proposals to Apple and concluded, in one instance, that the shareholder proposal could be excluded from proxy materials and, in the other, that the shareholder proposal must be included.

Legal Bulletin 14I In its discussion of the “ordinary business” exception, the SLB describes that the purpose of the exception is “to confine the resolution of ordinary business problems to management and the board of directors, since it is impracticable for shareholders to decide how to solve such problems at an annual shareholder’s meeting.”

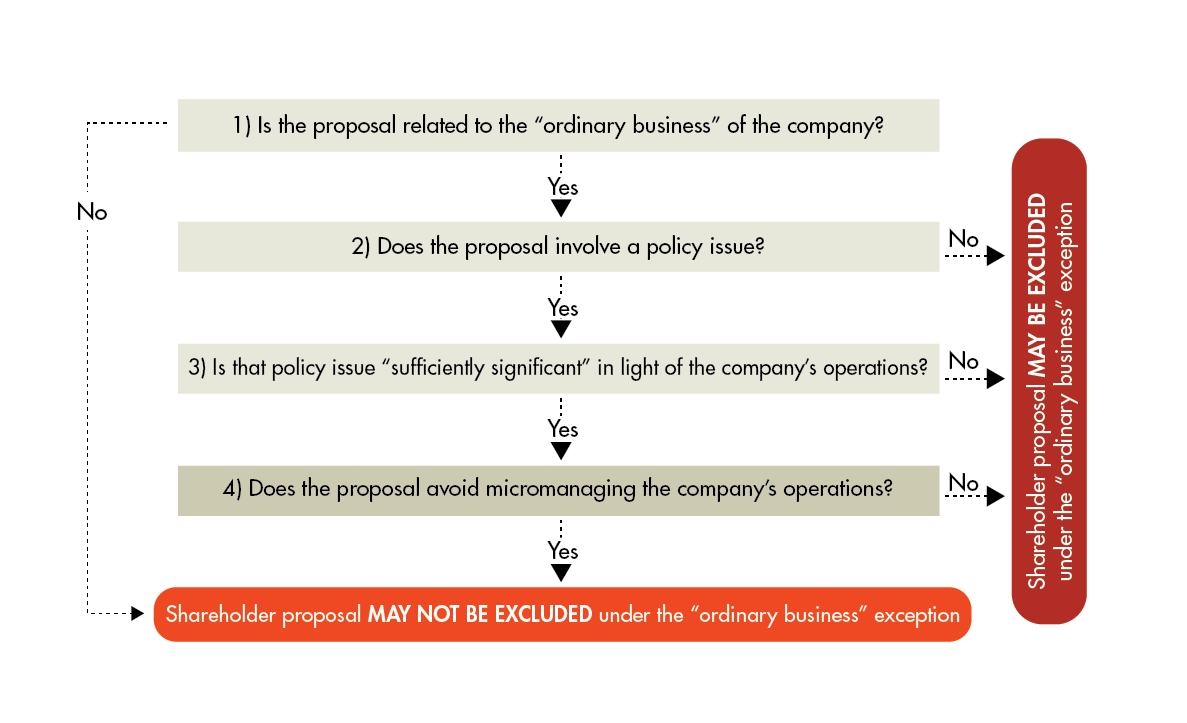

In considering whether a proposal may be excluded under this exception, the SEC describes that it takes into account two factors: (1) the substance of the proposal and (2) whether the proposal seeks to “micromanage” the company. With respect to the first factor, a proposal that deals with the “ordinary business” of a company may, nonetheless, be ineligible for the exception if the “proposal focuses on policy issues that are sufficiently significant because they transcend ordinary business and would be appropriate for a shareholder vote” (emphasis added). In determining whether a proposal is “sufficiently significant,” the SEC considers the connection between the policy issue and the company’s operations. The SLB goes on to state that such determinations can “raise difficult judgment calls” that are often resolved appropriately by the company. The SLB advises that companies, in their no-action requests, should “include a discussion that reflects the board’s analysis of the particular policy issue raised and its significance.”

We interpret the SEC analysis in the SLB as creating the Framework as follows:

Response to the Apple No-Action Letters On December 21, 2017, the SEC issued guidance, referencing the SLB, to Apple regarding whether the company could exclude two CSR-related shareholder proposals from its proxy materials. In each instance, Apple argued that the proposal could be excluded under the “ordinary business” exception. In one letter, the SEC informed Apple that it could exclude a proposal on greenhouse gas emissions (the “GHG proposal”), and, in a second letter issued the same day, the SEC advised that Apple should include a proposal on human rights (the “Human Rights proposal”).

So, what was the difference between the proposals and the Company’s response? And does it make sense that the SEC reached different conclusions with respect to the two proposals?

In short, the decisions reflect that the SEC applied the Framework described above. In doing so, the SEC found that the GHG proposal, while related to a sufficiently significant policy issue, sought to micromanage the company. Conversely, with respect to the Human Rights proposal, the SEC found that Apple did not adequately describe how the policy issue raised by the proposal was not “sufficiently significant” to the company’s operations. Each decision is discussed in more detail below.

The GHG Proposal In a no-action request to the SEC related to the GHG proposal, Apple urged the SEC to confirm that it would not recommend enforcement against the company if it excluded a proposal by Jantz Management LLC, on behalf of Christine Jantz, to include the following in the Company’s 2018 Proxy Materials:

Resolved: Shareholders request that the Board of Directors to [sic] prepare a report to shareholders by December 31, 2019 that evaluates the potential for the Company to achieve, by a fixed date, "net-zero" emissions of greenhouse gases relative to operations directly owned by the Company and major suppliers. The report should be done at reasonable expense and may exclude confidential information.

In a lengthy letter to the SEC, Apple argued that the proposal should be excluded because “the Proposal relates to the Company's ordinary business operations by requiring the Company to develop complex processes, policies, and technologies for the purpose of assessing the extent to which they would allow the Company (together with its major suppliers) to satisfy specific quantitative targets.” The SEC ultimately agreed with the company, finding that “the Proposal seeks to micromanage the company by probing too deeply into matters of a complex nature upon which shareholders, as a group, would not be in a position to make an informed judgment.”

The Human Rights Proposal In a similar no-action request submitted on November 20, 2017, Apple argued that a proposal submitted by Jing Zhao on human rights could be excluded under the “ordinary business” exception. Zhao proposed to include the following in the company’s Proxy:

Resolved: Shareholders recommend that Apple Inc. establish a Human Rights Committee to review, assess, disclose, and make recommendations to enhance Apple’s policy and practice on human rights. The board of directors is recommended, in its discretion and consistent with applicable laws to: (1) adopt Apple Human Rights Principles, (2) designate the members of the committee, including outside independent human rights experts as advisors, (3) provide the committee with sufficient funds for operating expenses, (4) adopt a charter to specify the functions of the committee, (5) empower the committee to solicit public input and to issue periodic reports to shareholders and the public on the committee’s activities, findings and recommendations, and (6) adopt any other measures.

In its no-action request to the SEC, Apple contended that “human rights are an integral component of the Company’s business operations,” and, therefore, the proposal “does not transcend the Company’s ordinary business or its day-to-day operations.” Apple did not argue that the proposal sought to micromanage the company’s operations.

Given Apple’s own attention to human rights issues and the description of its human rights-related commitments, the SEC advised that it was unable to conclude that “this particular proposal is not sufficiently significant to the Company’s business operations such that exclusion would be appropriate.” Having not argued that the proposal sought to micromanage the company’s operations, the SEC did not comment on that potential reason for excluding the shareholder proposal.

Takeaway The SEC’s seemingly divergent responses are therefore not unexpected under the Framework described above and may help both companies and shareholders formulate more effective proposals and no-action letters.

For shareholders, proposals must focus on policy issues that are sufficiently significant to the company and not request action that is too specific. The SEC may find that such proposals address issues that transcend day-to-day business matters without seeking to micromanage the company’s operations and therefore that they may not be excluded from proxy materials under the “ordinary business” exception.

On the flip side, in order to exclude a CSR-related shareholder proposal under the “ordinary business” exception, companies must demonstrate either that the issue is not “sufficiently significant” in light of their operations and/or that the proposal seeks to micromanage their day-to-day operations. As illustrated by the Human Rights proposal discussed above, the company’s analysis should likely evaluate both prongs in order to provide the SEC with more than one option for determining that the proposal may be excluded.

It remains to be seen whether activist shareholders are encouraged by the SEC’s guidance to file more CSR-related proposals. Companies should be prepared to consider these proposals in light of the Framework discussed here.